Van Finance Explained

Understand your CV buying options

at Macklin Motors

If you want to upgrade your work horse or your fleet, this page will explain the various buying options available when it comes to securing your new commercial vehicle. Please note, some deals are only available to business customers only, so to iron out any queries, ask your retailer direct. Please note, depending on your business status, all prices will be subject to VAT.

Cash Payment

We're happy to take full payment for your vehicle. You can pay this outright and full ownership of the vehicle will be transferred to you. If you've secured a loan to fund this cash payment and do not keep up with the repayments, your vehicle may be at risk.

Business Finance Lease

This is one of the most common form of leasing and is suitable for business customers with smaller fleets. This is a hire agreement whereby you take control of a vehicle for a contractual period - usually referred to as the 'lease period'. You will ordinarily pay an Initial Rental (remembering you are not actually going to buy the vehicle outright). Then you will make fixed monthly payments for the duration of the contract.

There is an option to include a balloon payment at the end of the agreement, (which will reduce your monthly payments) whereby you can pay any remaining credit on the vehicle. This gives the option to sell it on behalf of the finance provider. Alternatively, when the contract expires you can simply extend the lease or return the vehicle and take out a new lease. Some manufacturers may allow you to extend your agreement into a 'secondary' contract period for a nominal annual fee. VAT is payable according to the rental values only, not the cost of the asset.

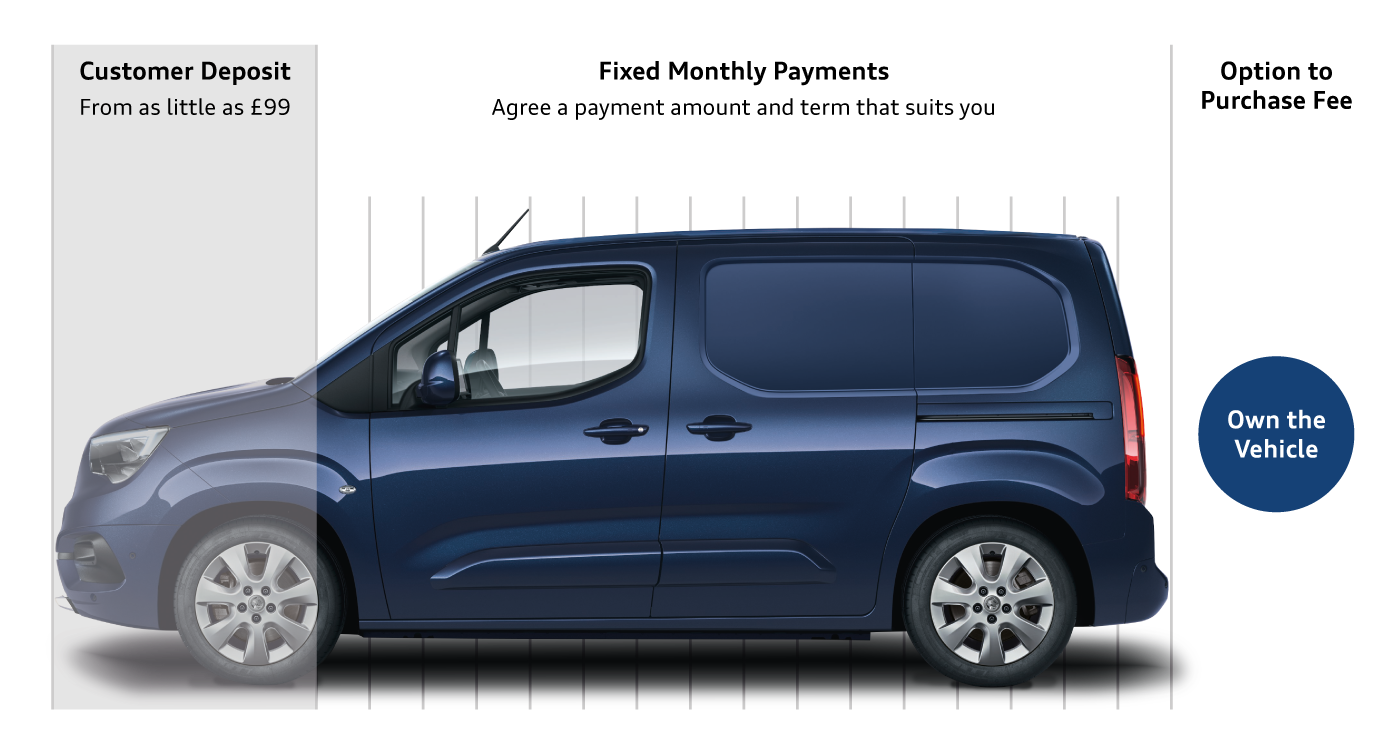

Hire Purchase (HP)

Hire Purchase is a way to buy a vehicle with the flexibility to choose the amount of deposit and the term of the agreement. As this is a fixed interest agreement the monthly payments will not change during the agreement.

The agreement is secured against the vehicle and you will not own the vehicle until you have made all of the payments, including any option to purchase fee. You can settle the agreement at any point by paying the settlement figure quoted by the finance company. Your vehicle is at risk of repossession if you do not maintain the contractual repayments.

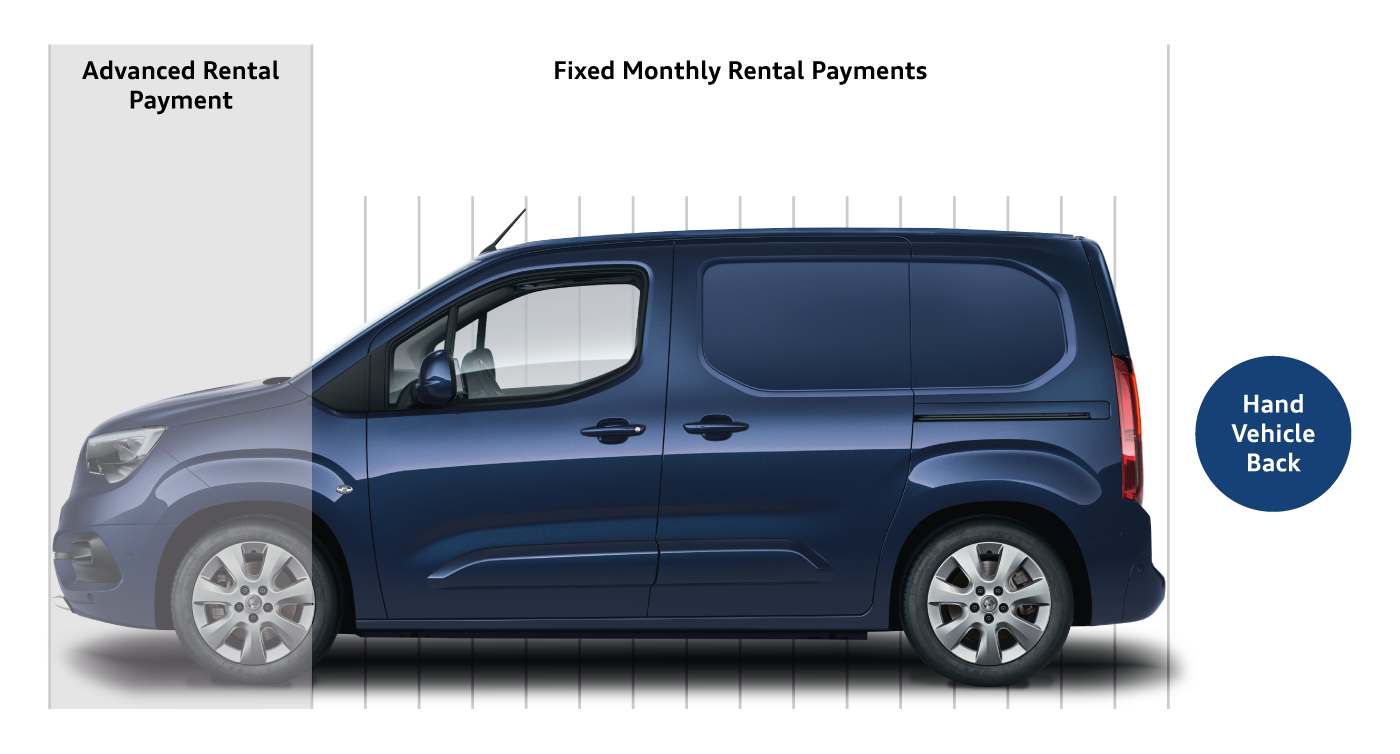

Business Contract Hire

Contract Hire is fixed cost motoring presuming a pre-agreed mileage and expected condition of your vehicle on return over a set period of time. Under this kind of agreement, the vehicle is hired for a set period at fixed monthly rentals. Ordinarily, an Initial Rental is paid. However, you never own the vehicle, so at the end of the contract (from 24 to 60 months) the finance company will collect it and dispose of it. It is possible to include a maintenance package in the monthly rentals. Monthly rentals will depend on the value of the vehicle, length of the contract, and the agreed mileage.

Occasionally you can add packages for servicing and maintenance, meaning less hassle and meaning less hassle and unpredicted costs. You agree an annual mileage as part of this agreement. If you exceed the agreed mileage, and choose to hand your van back at the end of the agreement, then excess mileage charges will apply. Your van must also be in fair condition for its age and mileage.

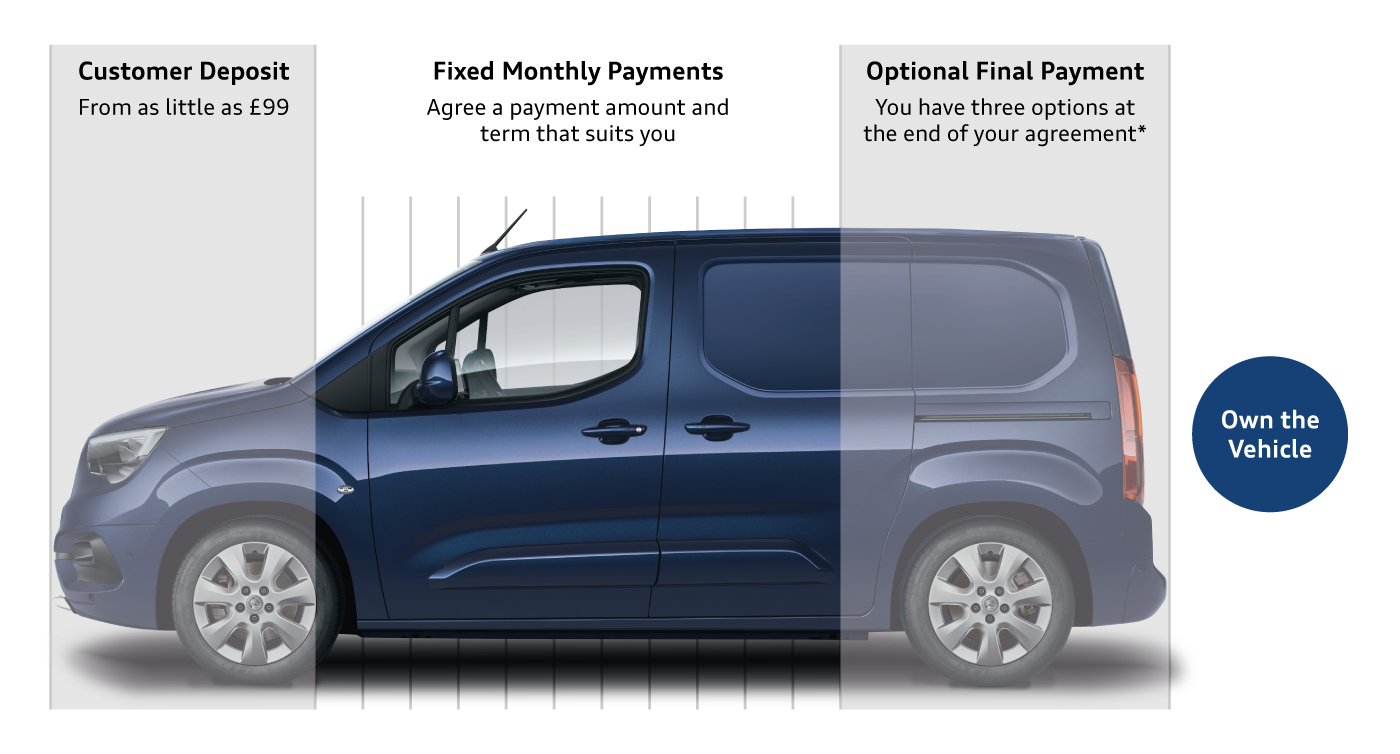

Personal Contract Purchase (PCP)

PCP is a very popular way to purchase that has some great benefits. It defers some of the vehicle cost until the end of the finance agreement. The deferred amount is known as the Guaranteed Minimum Future Value (GMFV) or occasionally referred to as Optional Final Payment or Balloon Payment. Interest on this deferred amount is included in the monthly payments that you are quoted. You have the flexibility to choose the amount of deposit and the term of the agreement and as this is a fixed interest loan the payments will not change during the agreement.

You agree an annual mileage as part of this agreement. If you exceed the agreed mileage, and choose to hand your vanback at the end of the agreement, then excess mileage charges will apply. Your van must also be in fair condition for its age and mileage.

*At the end of the agreement you have three choices:

- 1. Pay the GMFV in order to own the van;

- 2. Hand the van back.

- 3. Use any value above the GMFV as a deposit against another van (There is no guarantee that there will be any value above the GMFV).

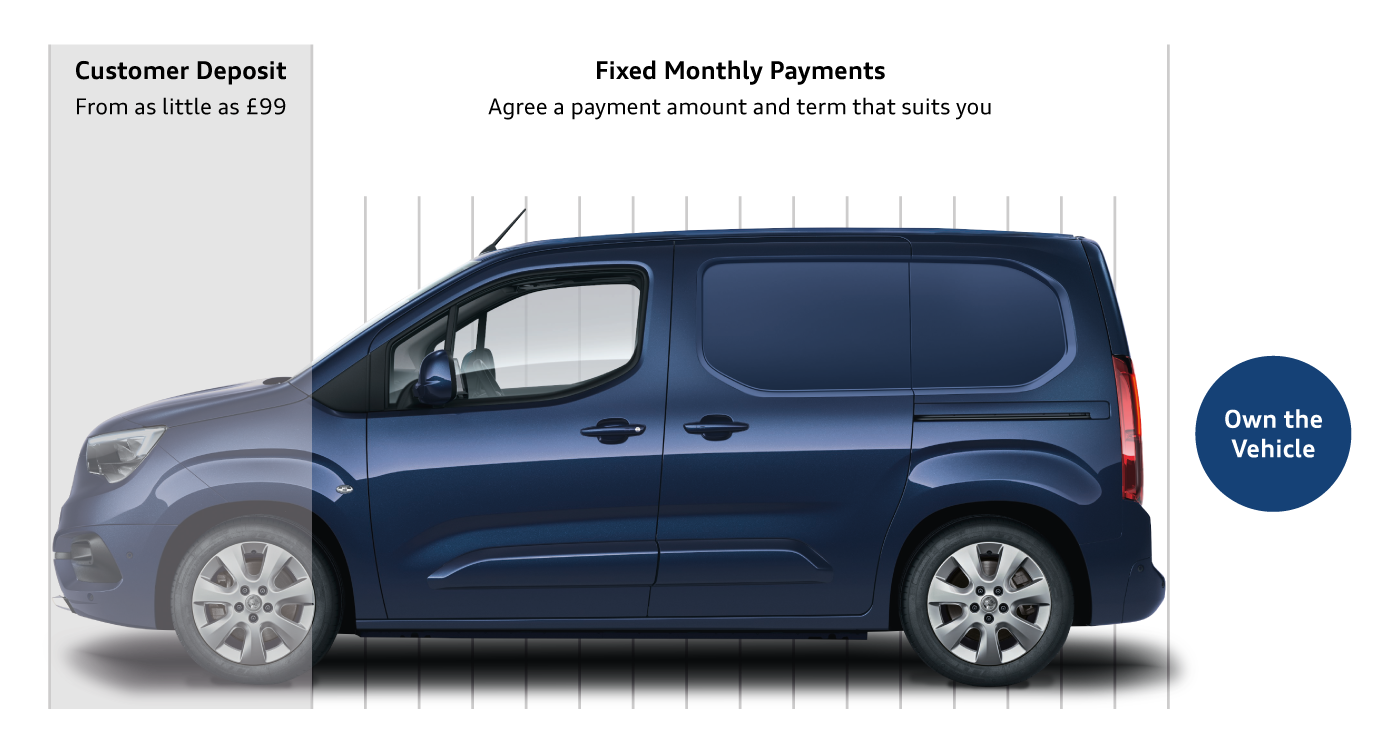

Conditional Sale

Conditional Sale is similar to Hire Purchase but the customer will commit to buying and owning the vehicle at the end of the agreement. There is no option to purchase fee and no option to hand the vehicle back. Ordinarily, the vehicle will be secured with a cash deposit or a part exchange. The remainder of the value is paid by the customer each month, over a period of 2-5 years depending on the agreement.

There are no mileage or servicing requirements as the customer will own the vehicle at the end of the agreement.

Terms & Conditions

For all of the finance options, we act as a broker not a lender. Our Finance Lenders may or may not pay us for the introduction. Your vehicle is at risk of repossession if you do not maintain the contractual repayments.